Credit scores range from 300 to 850 and you should strive to maintain a credit score of 700 or above. You can further generalize it to Pay by Credit Card Pay by Cash Pay by Check etc.

:max_bytes(150000):strip_icc()/dotdash-050214-credit-vs-debit-cards-which-better-v2-02f37e6f74944e5689f9aa7c1468b62b.jpg)

Credit Cards Vs Debit Cards Key Differences

In most cases the interest rates are higher.

. Now that you have a general understanding of what a use case consists of we are ready to start creating our use case. Youll receive rewards as statement credits. Store credit cards can negatively influence your credit score.

Use Case Descriptions actors - something with a behavior or role eg a person another system organization. An example of use cases for a Point of Sale POS Terminal or Checkout in a supermarket. Youll only be able to use a closed-loop card at the department store that offers the card.

Optional Functions or Additional Functions. 25 reward when you open your account and spend 25. It also offers some introductory incentives for new.

Use plain english and keep it simple. This is a pretty good discount but the savings are limited to 100 total. Before it can determine your creditworthiness the store must pull your credit.

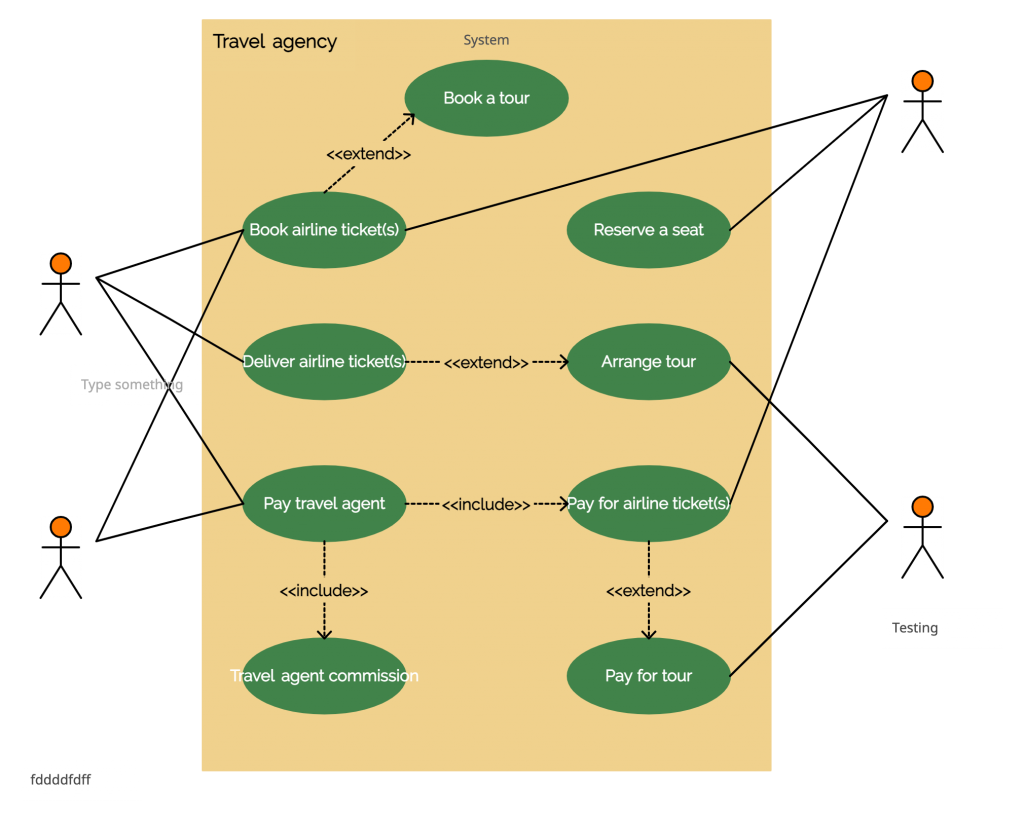

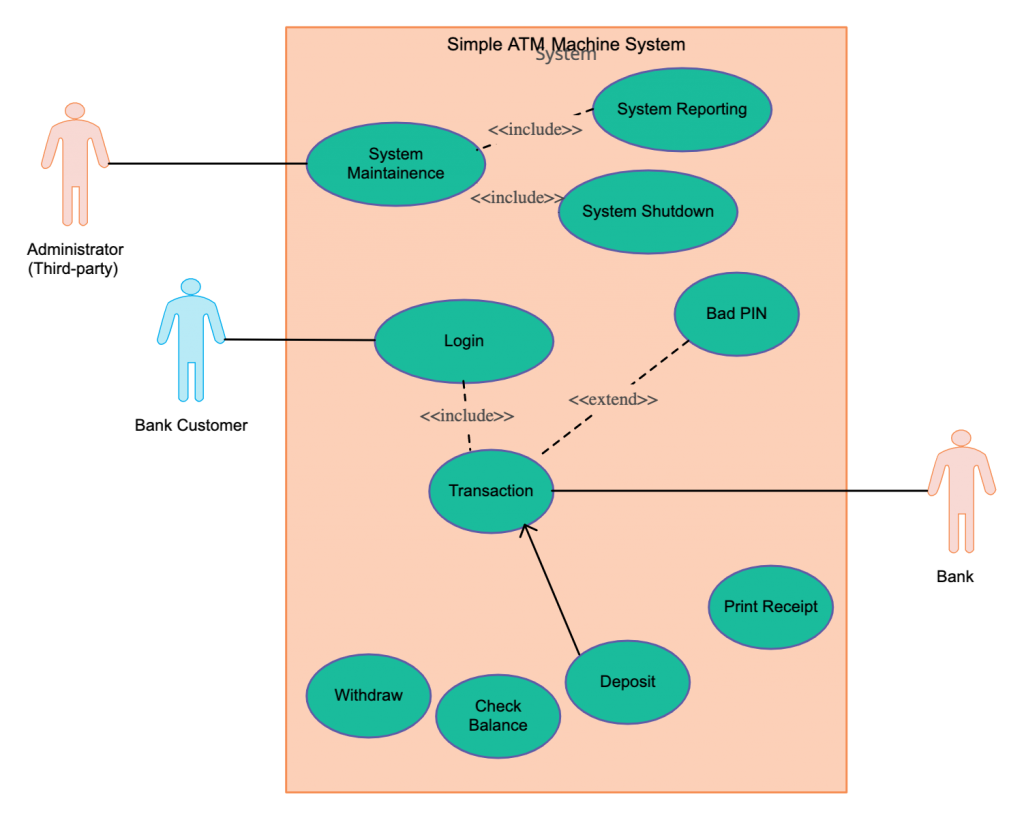

This Use Case Diagram is a graphic depiction of the interactions among the elements of Credit Card Approval System. Closed-loop retail cards are more common and only allow you to use your credit card with that retailer and in some cases its other brands and partners. The process of running a credit check when you apply for a department store credit card is referred to as hard inquiry.

One of the best examples of this is Make Payment use case in a payment system. Each use case is represented as a sequence of simple steps beginning with a users goal and ending when that goal is fulfilled. Retail Credit Cards Encourage High Utilization.

However if the department store has multiple brands you may be able to use the card at all of its locations. Even if a department store card is a traditional revolving credit line it may still be more expensive than a personal credit card. Earn a 1 cash back reward on all other purchases.

Just the act of applying for the credit card can put a small dent in your credit score. What Is the Average Interest Rate for Store Credit Cards. All of them have the attributes and the functionality of payment with special scenarios unique to them.

There are two types of store credit cards. With the Aspire Mastercard Credit Card you earn a 3 cash back reward on Gas Groceries and Utility Payments. Buyers are talked into spreading out their payments over.

Scenario - a specific sequence of actions and interactions between actors and the system aka. You can use these cards at any store that accepts cards. Described below using Visual Logic and case diagram Show More.

This means if you dont pay off the balance on your department store credit card every month youll accrue interest payments that are higher than those. Authorize and Capture use case is the most common type of credit card transaction. Typically while the name of your use case is being discussed people will start briefly describing the use case.

This card will have a payment network logo on it such as Visa or Mastercard. Probably the biggest drawback of a department store card is the incredibly high interest rates they charge. However these rates can be disguised.

Department store credit cards typically have higher annual percentage rates APRs than traditional credit cards do. Many department stores offer 0 financing for a short period of time. 5 points on a dollar for GAP purchases 1 point for other.

3 However some store. The main actors of Credit Card Approval System in this Use Case Diagram. Good credit needed not a great rewards rate for general rewards card.

In comparison the average interest rate on a general-purpose credit card is in the mid-teens. Name and briefly describe your use case. Pre-qualify without affecting your credit score.

Checkout use case involves Customer Clerk and Credit Payment Service actors and includes scanning items calculating total and taxes and payment use cases. Up to 25 cash back Develop a use case diagram for a department store credit card system. When you open a Macys store credit card youll earn 20 off either the day of or the following day.

The Stein Mart Platinum Mastercard earns rewards at the retailer online in-store and everywhere that Mastercard is accepted. It outlines from a users point of view a systems behavior as it responds to a request. Thats because credit inquiries made when you apply for credit make up 10 of your credit score.

During the settlement funds approved for the credit card transaction are deposited into the Merchants Bank account. The requested amount of money should be first authorized by Customers Credit Card Bank and if approved is further submitted for settlement. Macys uses a tiered rewards program for its cardmembers.

No credit check credit cards. That means credit issuers will perform a hard inquiry that will shave several points from your credit score. Variable 1790 to 2390 APR based on account type.

This is especially the case with store credit cards because they typically. While a single hard inquiry typically costs you no. Because store credit cards encourage high.

This check is mandatory for all new credit card applicants because it means that you are opening a new line of credit. The average interest rate for store credit cards is higher than conventional credit cards often as high as 2440. Up to 1000 credit limit subject to credit approval.

A use case is a written description of how users will perform tasks on your website. The interest rates on retail store cards continues to grow and the average interest rate is now just under 25. Include at least two actors and four use cases.

It represents the methodology used in system analysis to identify clarify and organize system requirements of Credit Card Approval System. The hard inquiry results are included in. General credit card for good credit.

Posted By freeproject on July 24 2017. This is an example of a large and complex use case split into several smaller use cases. Department store credit cards can also lead to financial trouble.

Can You Use Store Credit Cards Anywhere. A use case instance use case - a collection of related success and failure scenarios describing actors using the system to. The Walmart credit card lets you save money on gas and all in-store and online Walmart purchases.

In some cases only. If you spend up to 499 annually youll qualify for Silver status. The Cons of Department Store Credit Cards.

How Credit Card Processing Works Understanding Payment Processing

Use Case Diagram Tutorial Guide With Examples Creately Blog

China S Social Credit System 15 Social Credit Know Your Meme

0 Comments